General Liability Insurance in North Carolina

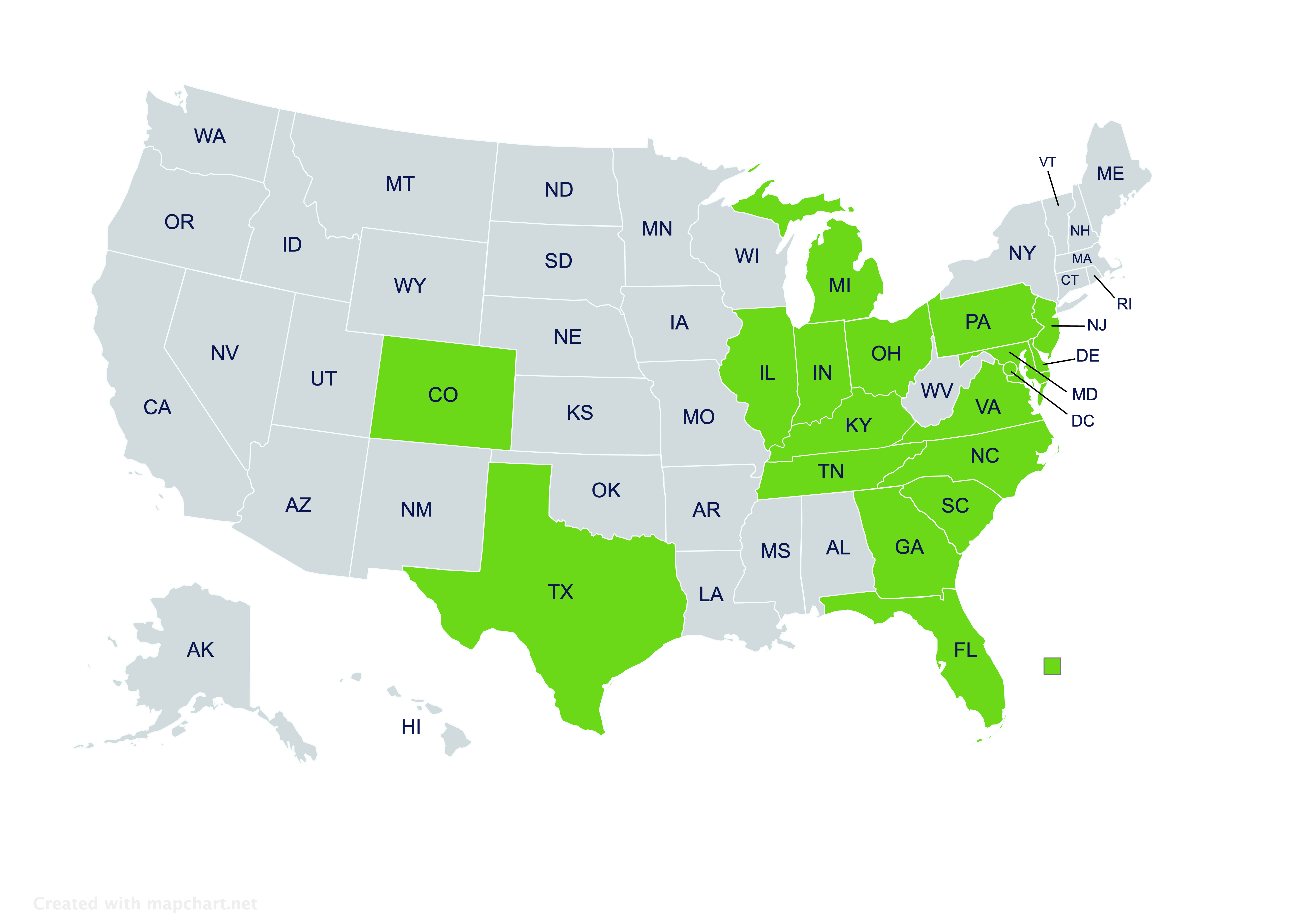

Providing general liability insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

General Liability Insurance in North Carolina

What is general liability insurance?

Some risks are common across industries and businesses. General liability insurance may help North Carolina businesses protect against many of these common risks.

General liability insurance is a foundational liability coverage. Policies may cover a range of common accidents and some other risks, usually paying legal fees and settlements for covered claims.

Which North Carolina businesses need to have general liability coverage?

General liability coverage is something that almost every business in North Carolina should consider. Not insuring against common risks can result in expensive lawsuits.

What protections are included in general liability policies?

Like most insurance policies, general liability policies normally come with several specific protections. These can include:

- Bodily Injury Coverage: Usually for routine accidents (not auto) that cause injuries to a third party. This may be limited to accidents at a business’s premises, or it may extend to things that happen off-site.

- Premises Liability Coverage: Usually for routine accidents that result in third-party injuries, but is typically limited to only those that occur at a business’s location or property.

- Property Damage Coverage: Usually for routine accidents that cause damage to a third party’s property. Protection may be limited to a business’s premises, or extend to off-size accidents.

- Personal and Advertising Injury Coverage: Usually for defamation lawsuits and allegations of harmful advertising practices.

A specialized insurance agent who knows general liability policies well can explain these protections in greater detail.

Are car accidents covered by general liability?

Car accidents normally aren’t covered by general liability. The common accidents that general liability protects against tend to be trips, slips, falls, and similarly routine mishaps. Commercial auto coverage is typically needed for protection against car accidents.

Are slips and falls covered by general liability if the injured person is drunk?

When a business sells alcohol, general liability will frequently exclude any accidents where an injured person is drunk. A slip or fall probably wouldn’t be covered in this case.

Liquor liability coverage normally covers routine accidents when the injured person is drunk. It can almost always be paired with general liability in a package policy.

Are businesses legally required to have general liability?

Most businesses aren’t legally required, either by federal law or North Carolina state law, to have general liability coverage. There might be a few exceptions, but it’s not a legal requirement for most businesses.

This isn’t to say that businesses should forgo coverage, however. Some customers might only hire a business if they have general liability in place. More importantly, not having coverage could result in enormous legal fees if something happens.

How can businesses get a general liability certificate of insurance?

A certificate of insurance (COI) is a document that verifies the stated insurance coverage(s). It gives customers and others a way to confirm that a business has certain insurance, such as general liability.

Businesses may receive a COI when purchasing a policy. A certificate can also easily be requested through an insurance agent, and the process doesn’t take long. It’s often ready within a business day, and possibly on the same day if delivered via email.

How much does general liability coverage cost?

Premiums for general liability policies can vary quite a bit. Some details that insurance companies often consider include:

- Whether coverage is limited to a business’s location

- What type of industry a business is in

- How large a business’s location is

- How many annual sales a business has

- Whether a business recently made any insurance claims

Businesses can find out how much their general liability coverage will be by working with an independent insurance agent. An independent agent has the freedom to compare policies from multiple insurance companies.

Where can North Carolina businesses find general liability insurance?

For help finding general liability insurance, contact the independent insurance agents at Laurie Insurance Group. Our agents have helped many North Carolina businesses with liability coverages, and we can make sure you find the right general liability for your business.

Working hours

Mon-Fri 9 am -12 pm and 1 pm – 5 pm

By Appointment Only: 12 pm – 1 pm

Our Central Service Center

Social profiles

Get in touch!

Contact us today for questions or insurance quotes!