Directors and Officers Insurance in North Carolina

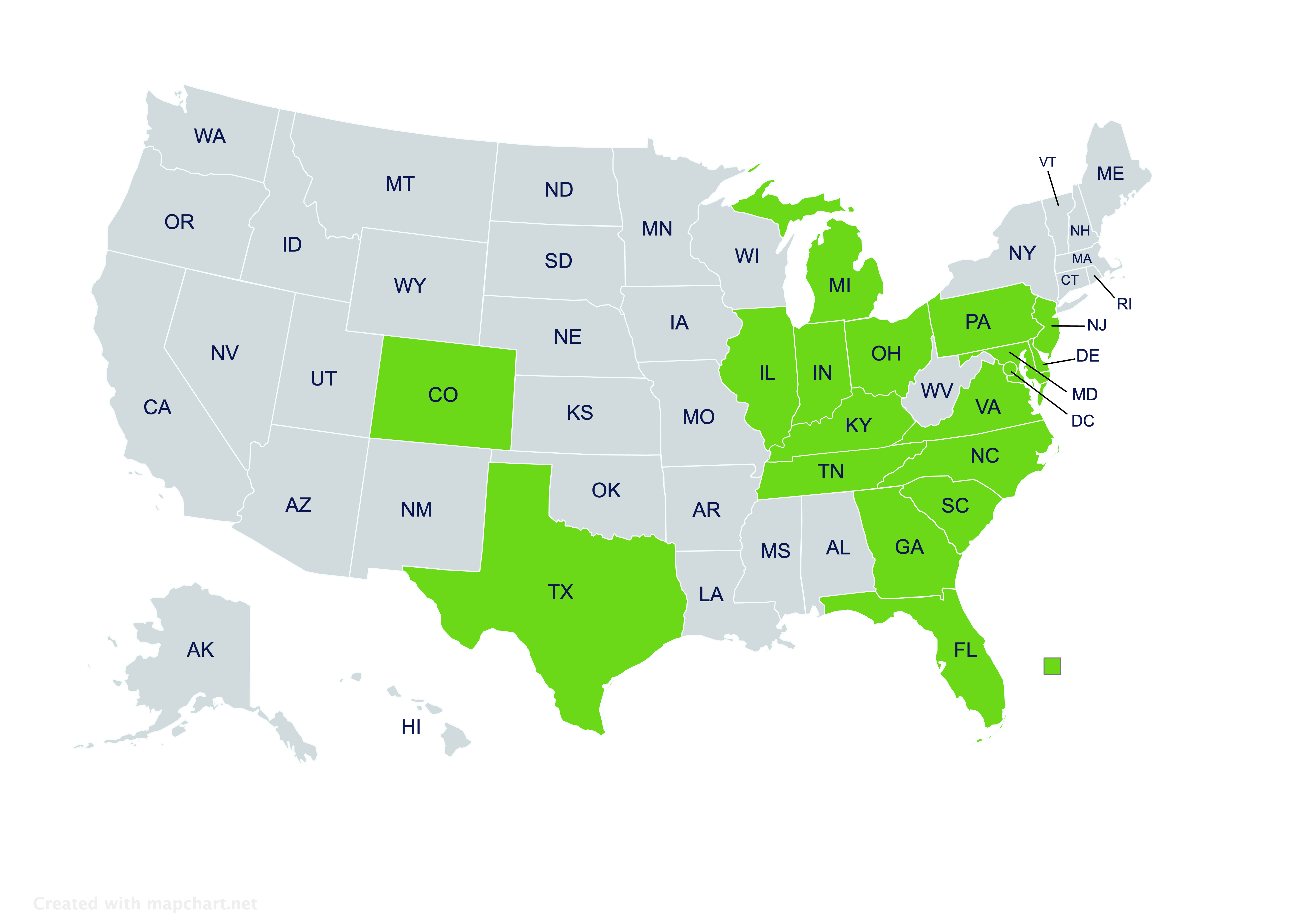

Providing directors and officers insurance solutions to residents in North Carolina and beyond.

Get a Quote

Send us your information for a free quote!

Directors and Officers Insurance in North Carolina

What is directors and officers insurance?

Accepting a senior leadership position comes with responsibilities, and also risks. Directors and officers insurance may help shield senior leaders of North Carolina businesses and nonprofits from some of the risks that come with their position.

Directors and officers insurance is liability coverage for senior leaders of businesses and nonprofits. Policies may protect leaders if their decisions or actions negatively impact an organization.

Who in North Carolina should be purchasing D&O insurance?

D&O insurance is something most people holding senior leadership positions might benefit from. Leaders of businesses and nonprofit organizations in North Carolina generally should consider a policy. For example, D&O policies are frequently used to protect:

- C-level executives and directors

- Presidents and vice presidents

- Board chairpersons and board members

- Treasurers, trustees, and other fiduciaries

- Advisory partners

Without D&O coverage in place, these leaders could be personally liable for decisions or actions that have a major negative impact on their organization.

What decisions and actions do D&O policies cover?

The exact situations that any insurance policy covers are determined by that policy’s terms. Depending on terms, D&O policies might protect against decisions and actions such as:

- Misleading statements

- Misrepresentations

- Funds misappropriations

- Decisions resulting in bankruptcy

- Overall poor corporate governance

Notably, simply bad business decisions that cost organizations normally aren’t covered. Leaders still need to understand their organization, its position within the competitive landscape, and how to set the organization up for success.

Additionally, any coverage that’s provided is usually void if an action is criminal, or intentionally to harm the organization.

Are breaches of fiduciary responsibility covered by D&O policies?

D&O insurance can often be set up to cover fiduciary breaches, but it’s important to confirm that potential breaches indeed are covered. An insurance agent who specializes in D&O will be able to confirm whether a chosen policy has the protections that fiduciaries need.

What are the different “sides” in D&O policies?

The protections that D&O policies are often classified as different “sides.” There are three main sides:

- Side A: Usually for senior leaders personally. This may provide financial assistance if an organization doesn’t have enough funds to pay a leader’s legal expenses for a covered claim. Coverage might be needed if an organization doesn’t have enough financial reserves or becomes insolvent.

- Side B: Usually for businesses and nonprofits. This may provide financial assistance if an organization faces legal action, because of a senior leader’s decision or action.

- Side C: Usually for public companies that require protections specifically related to securities risks. A few private businesses might also need this side.

Do both businesses need their own D&O coverage during a merger?

Businesses and leaders that need D&O coverage during a merger should work closely with an insurance agent who knows D&O insurance well. These are complex situations rife with potential lawsuits. A highly knowledgeable agent can help make sure that all involved parties — businesses and senior leaders alike — have solid D&O coverage in place.

Do leaders or organizations pay for D&O coverage?

In many cases, organizations pay for D&O coverage even if the coverage protects senior leaders. Since leaders usually only need coverage because of their work for a business or nonprofit, it’s fairly common practice for the business or nonprofit to pay for a policy.

To find out how much a policy will cost, organizations can shop around with an independent insurance agent. An independent agent has the flexibility to get quotes from several insurers, which makes comparing rates, sides, and other coverage details easy.

How can North Carolina businesses and nonprofits get directors and officers insurance?

For help finding directors and officers insurance, contact the independent insurance agents at Laurie Insurance Group. Our agents will help you find a policy that protects your North Carolina organization, and its senior leadership, well.

Working hours

Open | Mon-Fri 9am – 5pm

Closed | Sat-Sun & Holidays

Our Central Service Center

Social profiles

Get in touch!

Contact us today for questions or insurance quotes!